Are you ready to start the journey of homeownership? As you start this journey, you will create saving goals for your down payment and closing costs. But do you know how much you actually need for your down payment?

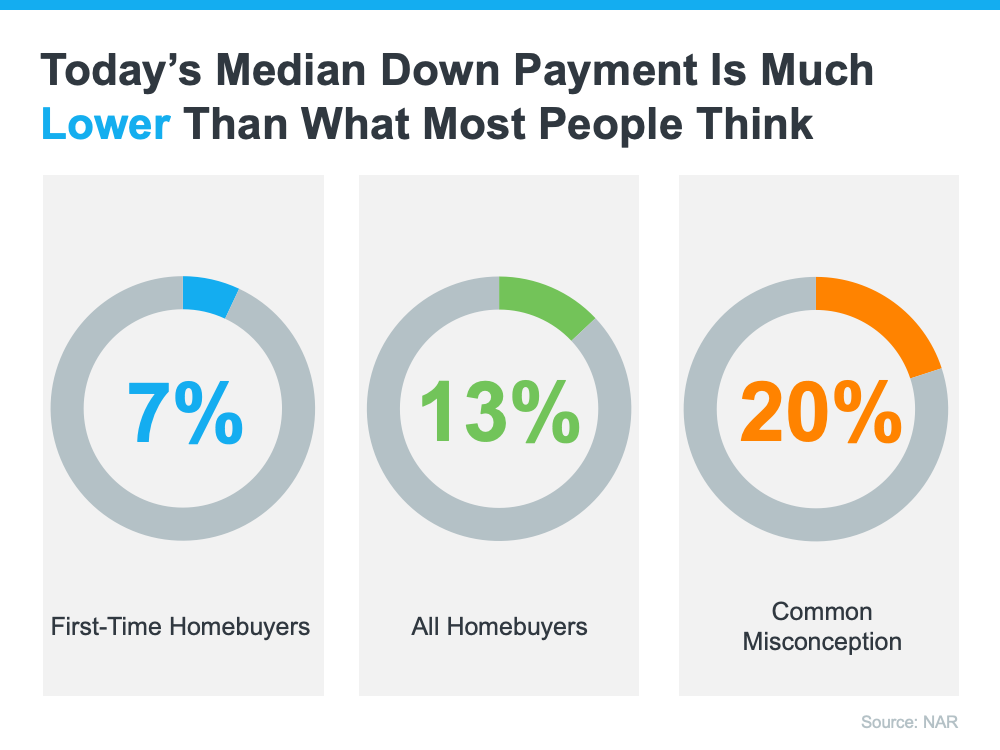

Freddie Mac states that “the most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

Generally speaking, you will need between 5% and 20% of the home’s purchase price for a down payment. The National Association of Realtors (NAR) reported that the median down payment hasn’t been over 20% since 2005. Today, the median down payment is only 13%, with first-time homebuyers’ median down payment being only 7%.

However, there are programs available that can help you with as little as 3% down. For example, the Federal Housing Administration (FHA) offers a 3.5% down payment program, and the Department of Veterans Affairs (VA) and the United States Department of Agriculture (USDA) offer programs with 0% down.

What Does This Mean for You?

Larger down payments have their benefits, mainly lower mortgage rates, and monthly payments. But if you can’t swing a 20% down payment, don’t worry! To understand your options, you need to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like downpaymentresource.com.

Assistance Programs

According to downpaymentresource.com, thousands of financial assistance programs are available for homebuyers, like affordable mortgage options for first-time buyers. Of the many available programs, down payment assistance options make up the large majority. They say 73% of the assistance available to homebuyers is there to help you with your down payment.

Tips to Save for Your Down Payment

Whatever your down payment, what are some ways to help save that money? Each month, pretend you already have a mortgage payment and have that amount deposited into savings. Once you have saved enough for your down payment, you can use that money as extra payments on your mortgage to help pay it off faster! Another tip is to get creative with your living situation. Maybe move from a two-bedroom apartment to a one-bedroom or consider a temporary roommate. The additional income can be put towards savings.

Saving for your down payment may seem daunting, but remember that you don’t have to go at it alone. Talk to a real estate agent or lender to start your home buying journey today!

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link